Introduction

The responsibilities of boards of directors continue to evolve and increase, particularly given the events of the past year. In addition to perennial topics such as strategy, succession, financial reporting, compliance, and culture, boards are experiencing broader demands on their oversight from expanding stakeholder and shareholder considerations; continuing challenges of the ongoing global pandemic and its aftermath; and addressing the changing role of the corporation in society at large on matters such as racial justice and climate. The growth in the number and complexity of board responsibilities is taking place in an environment of growing skepticism towards our various institutions.

Against that background, companies and their boards can help to address these multiple challenges by considering one of the most critical assets not on their balance sheets―trust.

What is trust?

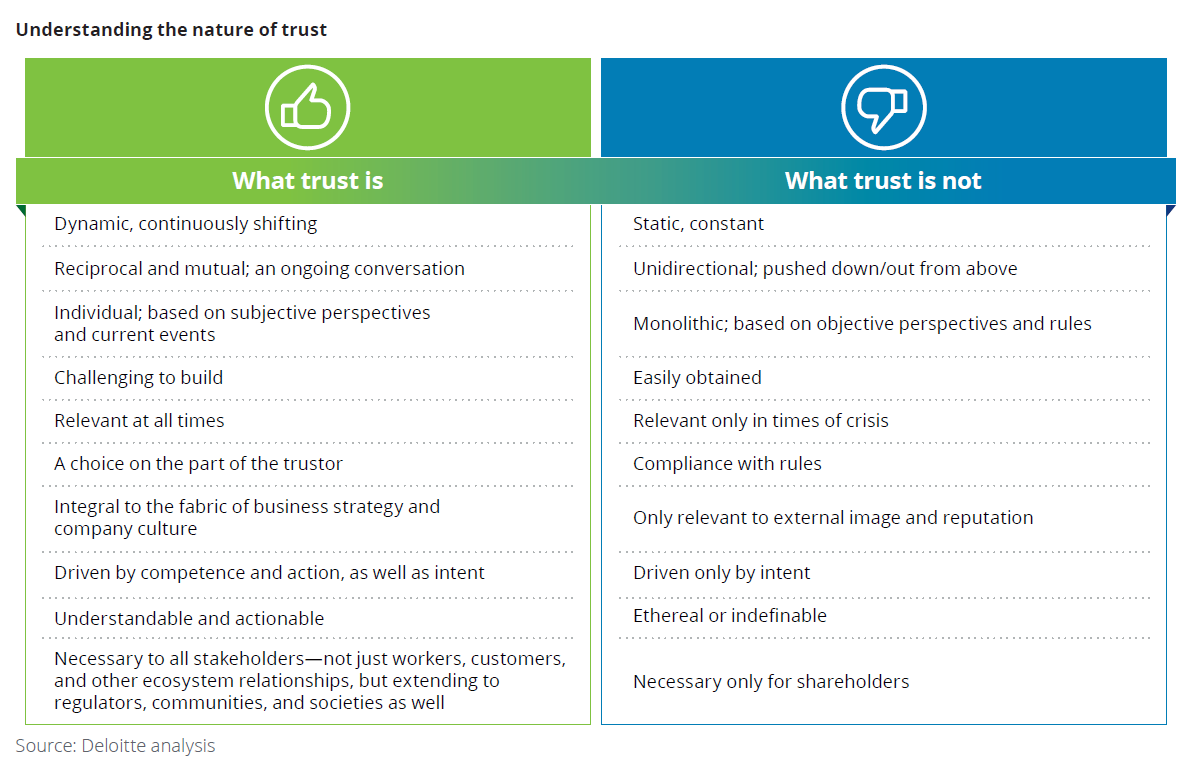

Trust has been defined as “our willingness to be vulnerable to the actions of others because we believe they have good intentions and will behave well toward us.” [1] However, particularly for a business enterprise, trust is not an ephemeral quality or attitude. Rather, it is a critical asset, albeit one that is not reported on the balance sheet or otherwise in the financial statements, as it has no intrinsic value.

However, trust is very real and concrete. When invested by leaders in relationships with stakeholders, it enables activities and responses that can help build or rebuild an organization and enable an organization to achieve its intended purpose. Trust can also be created across various groups within the organization―between the board and management, employer-employee, among the workforce, organization and stakeholder, vendors and customers. Conversely, a breach of trust can cause a company to lose significant value. For example, a Deloitte Canada analysis found that three large global companies, each with a market cap of more than $10 billion, lost from 20% to 56% of their value, or a total of $70 billion, when they breached their stakeholders’ trust. [2]

In other words, although trust does not appear on the balance sheet, it is a critical asset that can have a huge impact―positive or negative―on an organization’s market value.

The role of the board and basics

There seems little doubt that boards are responsible for overseeing trust as a corporate asset. Oversight of trust is critical to the board’s key role in overseeing strategy―increasing trust and thereby increasing value―and risk-mitigating reductions in trust and resultant reductions in value. Moreover, boards cannot ignore an asset that can so greatly influence the value of the enterprise.

Sandra Sucher, Harvard Business School Professor of Management, studies the role of executive leadership and trust. She emphasizes the important role boards play:

“Great boards lead when it comes to creating an atmosphere and philosophy of trust. Directors serve as a critical link between the management inside an organization and those stakeholders on the outside. Fundamentally, trust in an organization is built on both competence and intent―specifically the perception of an organization’s motives, means and impact. An effective board will cultivate trust within the board, and relationships in and outside the organization to ensure that trust is nurtured and maintained.” [3]

To effectively oversee trust, a board should start with some basic understandings, as follows:

- Trust is manageable: Leaders can build and maintain trust by acting with competence and intent. Competence refers to the ability to execute―to follow through on what you say you will do. Intent refers to the meaning behind a business leader’s actions― taking decisive action from a place of genuine empathy and true care for the wants and needs of stakeholders while being transparent in doing so. [4] The effectiveness with which an organization acts with competence and intent can be measured, managed and tracked over time.

- Trust is owned by management; the board’s role is oversight: Trust is built from the inside out. [5] The C-suite has the in-depth understanding of the company and its strengths and vulnerabilities needed to effectively manage trust through competence and intent across the entire organization. The board’s role with respect to trust is oversight rather than ownership.

- Trust is all-encompassing and ever-changing: Trust―or its absence―extends to all aspects of the company, and permeates the culture of the company. Trust constantly evolves as the company changes and responds to internal and external developments and challenges. For example, companies’ responses to the pandemic have had significant impact on how their workforces and other stakeholders viewed them from the perspective of trust. [6]

- Trust is a critical part of the “tone at the top”: Trust is a critical component of how the board and management function, both within themselves as well as in their dealings with each other. Can directors have candid discussions and even disagreements without losing trust in each other? Will the constructive tension between the board and management render trust between the two difficult or impossible to maintain?

Practical steps for the board…

Read The Full Article at Harvard Law School Forum on Corporate Governance